How to Get a Startup Job in 2025

A 7-part series for generalists in tech (5,500 words)

I recently landed a new job at a VC-backed startup. A lot of people have asked how I did it.

The job market is rough. Big Tech is still cutting. Consulting and banking roles are shrinking (and for many, they feel like a dead end). Many ambitious friends I know are stuck: they want growth, but don’t see a clear path.

Startups seem like a solution: faster learning, bigger impact, maybe meaningful equity. But they’re also risky. 9 out of 10 fail. You work more for less pay. And most “life-changing equity” isn’t.

So how do you know if a startup is worth joining — and how do you actually land the role?

This guide is tactical. Frameworks, templates, and questions to help you figure out if startups are right for you, and how to find one that fits. (And a few memes 🧌)

Who am I?

I’m Hannah. I started my career in finance, then jumped into a startup abroad where I worked across product, ops, and strategy. That experience accelerated my growth in a way banking never could.

Since then, I’ve worked in Big Tech, PE-backed tech, and early-stage startups. Today, I work in marketing at a startup, and I also create content on tech, careers, and personal branding for an audience of 130K+ across the internet.

Who are you?

You’re thinking about working at a startup for the first time, or you’re looking for your next role and want an actionable refresher on how to navigate the process

You’re focused on non-technical roles - think BizOps, Chief of Staff, GTM, marketing, strategy, customer success, etc.

Why am I writing this?

I got my first tech job mostly by chance. I didn’t know anyone in Silicon Valley. I didn’t have a built-in network from school. I had no idea which startups were “hot.” I just needed a job and stumbled into one. Banking got my resume noticed, but I still felt like I was flying blind.

And honestly, there still isn’t much good content on how to get startup jobs. Most of what’s out there is generic, outdated, or too fluffy to be useful. The reality is you usually have to already be in the ecosystem, networking and coffee chatting your way through, to figure out how things work. Every time I talk to friends who are job hunting, I end up repeating the same advice.

This guide is my way of putting it all in one place. I want to make it easier to find a company and role that actually accelerate your career. Especially if you’re an outsider with skills, energy, and industry expertise who wants to contribute to the startup ecosystem.

Part 1: Are startups right for you?

Startups aren’t a good fit for most people, especially at the early stage. Org charts are messy. Budgets are tight, priorities change all the time, and you’re figuring out things as you go. You might not have a 401K. There’s no clear onboarding plan or experienced manager guiding you in most cases.

These are both you:

Most startups don’t make it. 90% of startups fail, and 75% of them never return cash to investors (and employees). The odds of joining a life-changing “unicorn” are tiny.

This doesn’t mean you should avoid startups. It means you should be honest with yourself about why you’re taking the leap.

Bad reasons to join a startup:

You want to get rich quickly. See startup failure rates above. Even when startups do succeed, employee equity pools are often tiny and won’t yield returns as big as you think they will.

You want a fancy job title like “VP of Growth”. Even though you’re only 23. What you do matters more than your job title at a startup, and the title won’t always translate if you move to a different industry or larger company.

You want top-tier training and guidance. While you learn quickly at a startup, most of it is teaching yourself and learning by doing. If you want more structured career mentorship and guidance, especially at the beginning of your career, early-stage startups are not the best place.

You think working at a startup is cool and want clout. This is the same reason you shouldn’t work at an investment bank just because of the prestige. That fades away. The work doesn’t. Besides, a startup no one has ever heard of isn’t nearly as prestigious as Goldman Sachs.

You want to manage a big team. Startup teams are only getting leaner with AI, and big operational teams from the marketplace era are getting rarer.

You want to work in Strategy only. Ex-consultants: I’m looking at you. Most early-stage startups don’t have pure strategy roles. You’ll need to roll up your sleeves and execute.

Good reasons to join a startup:

You want to build entrepreneurial muscles before founding your own thing. This is the best reason to join a startup, especially in a generalist role like Chief of Staff or BizOps, IMO.

You want maximum learning velocity and are good at teaching yourself.

You want real responsibility to get shit done, not just build a deck on how to get it done.

You care about working with a small, driven team. This is true in most cases if you pick the right team.

You want to break into a role that may otherwise be hard to break into. It’s much easier to get a Product Manager role at a small startup than at Meta, and you’ll probably learn a lot more even if you decide to move to Meta later on.

You thrive in scrappy, high-agency environments. If you find corporate environments too stuffy or slow-moving and asking five people to sign off on a single doc gives you the ick, startups might be for you.

You’re excited about an industry, want to make a positive impact in it, and want to build something cool!!

When should you join a startup?

Right out of college: You’ll learn fast, but you may miss out on the comprehensive training and resources big companies provide, especially if you’re new to business and tech.

After 2–3 years in consulting, banking, or big tech: Great timing. You’ll bring structured skills and credibility. Many startups look for a few years in professional services for non-technical roles, especially for Chief of Staff / BizOps roles.

After 3-5 years in a different industry: I’d look for roles that allow you to use your industry expertise (e.g. working at a proptech startup if you have experience in real estate) or your functional expertise (eg. a sales role if you worked with customers before).

Part 2: Choosing a startup

Getting a job at a startup is way messier than recruiting for a bigger company with established timelines and processes. I typically follow a process that employs structure but also embraces “chaos”:

Narrow down to a target list of 20-30 startups to strategically target that match my key criteria (e.g. “B2B SaaS startups, Series A-C, based in New York”), regardless of whether they have an open role

Apply to any interesting roles I come across that fit ~80-100% of my criteria

Building a target list

If narrowing down to a short list of startups you’d want to work at feels overwhelming and you don’t know where to start, I always break it down to a 3-step process:

Stage → Industry → Companies

If you have other criteria like location preferences, add those. If you’re international and need visa sponsorships for the US, here is a list of startups that sponsor as of 2025.

Stage

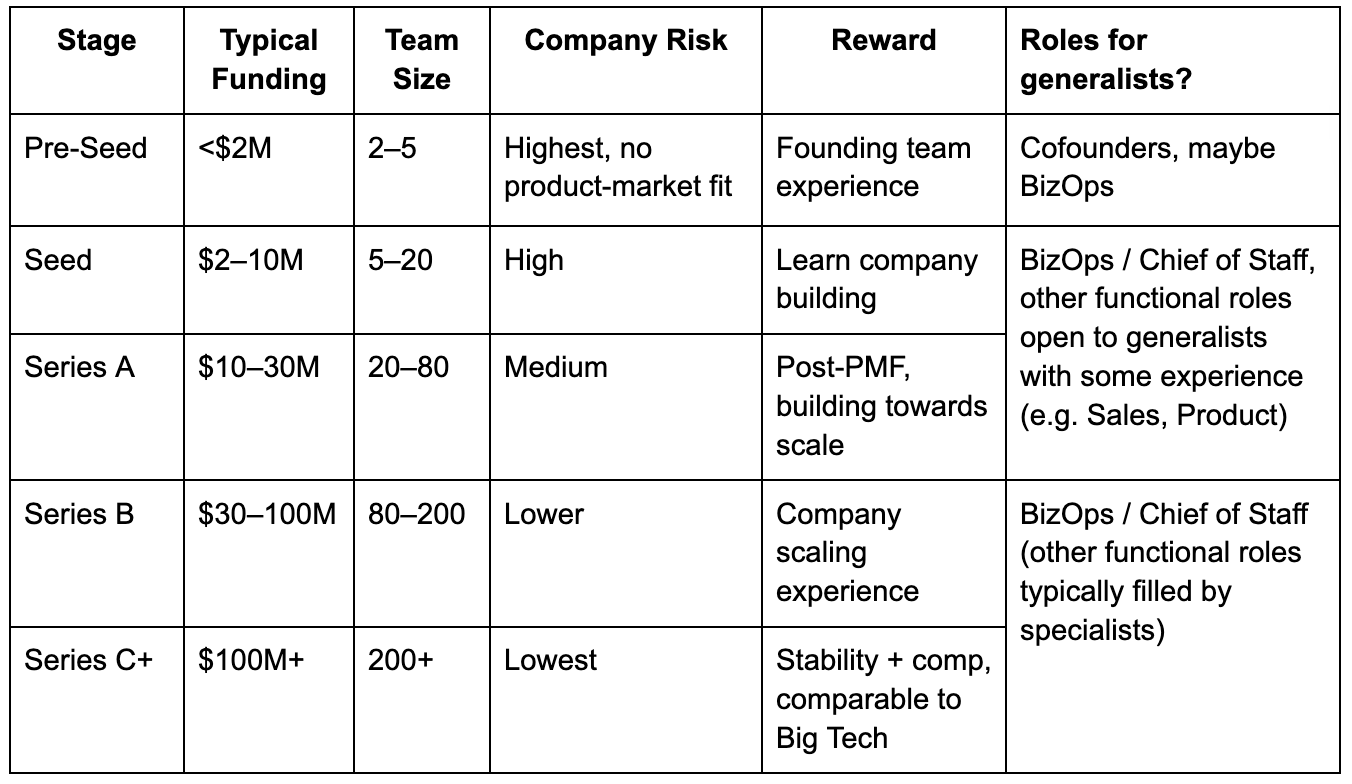

“Startup” can mean anything from 2 cofounders working out of a garage to a company like OpenAI with thousands of employees around the world. So narrow that down first, as the stage will have a major impact on your role and day-to-day.

Here’s a quick snapshot of startup stages:

📖Dan Hockenmaier, Head of Strategy at Faire, wrote a great essay about When to Join a Startup. Read more about what Y Combinator says about the different startup stages here.

I don’t recommend joining a startup before the Seed stage as a non-engineer unless you have deep conviction and experience with the founder(s). Otherwise, you might as well be a cofounder for your own company. After that, it’s a matter of aligning:

Your own risk/reward preferences

Why you want to work at a startup:

If you see this as a precursor to entrepreneurship or want to break into a role without deep functional expertise, I’d explore joining earlier (Seed/Series A).

If you want to join a startup that’s scaling with a stronger reputation, learn from some of the best in the industry, and have more structure, then Series B onward is a good spot.

⚡Not all startups are VC-backed. This guide focuses on VC-backed startups, as these tend to be high growth and offer the types of career acceleration and equity opportunities most people look for. There are bootstrapped startups (where funding stages don’t apply). These are harder to find, often through targeted job postings or recruiters, but can yield interesting opportunities to learn and earn.

Industry

TLDR: Think like an investor. Pick an industry with a big, growing TAM (Total Addressable Market) + where you have personal interest/experience.

If the market is tiny, customers are hard to find, investors won’t care, and your work feels stagnant. If you don’t care about a market, you’ll burn out fast - even if the market is massive.

I’d start by looking at your interests and experiences from existing roles, schoolwork, or projects you’ve done. What sparks your interest? What experiences translate well to certain industries?

Picking an industry:

TrueUp’s sector lists are a good place to start

Antler’s TAM/SAM/SOM guide can help you estimate market sizing

a16z puts out an annual request for startups where they call out top sectors where they want to invest

VC firms like Contrary and Lightspeed put out in-depth industry reports that may inspire you

The Generalist puts out an annual list of Future 50 startups. Look for industry trends there.

Company

Once you have criteria like stage, industry, and location, use the following resources to find companies that match them:

Crunchbase / Pitchbook → This is always my first stop to download a list of companies that fit my criteria. I typically filter for startups that raised funding within the last 6 months to 1 year. Do note - Some startups are inactive or information can be outdated/incomplete, so you may have to look up their Linkedin pages to check headcount, activity, etc. (FYI: Crunchbase has a free 7 day trial, and a lot of universities offer access to Pitchbook - ask your friends in school!)

VC portfolio pages → portfolio = pre-vetted pipeline. If you’re interested in a specific industry, look for smaller funds focused on that industry as well (e.g. Ally Bridge for Healthcare)

Location-based lists like this one for NYC, or posts from Twill’s growth lead with maps of NYC, SF, and Remote startups.

LinkedIn / Twitter → Follow key people in the tech/startup world, particularly in your target industry. You’ll learn about startups and interesting companies - win, win. This list is a super basic but good place to start, but my best advice is get on these platforms and build your own timeline.

Lists of top startups from Harmonic and The Generalist

Why you should join newsletter - deep dives on interesting, trending startups

Founders you should know newsletter

Reasons to Not Join a Company

Weak founder–market fit (founders lack expertise or conviction in the space)

Vague pain point / tiny TAM

Messy fundraising history (down rounds, short runway, no strong investors)

High founder or team churn

Poor customer feedback

Chaotic priorities (constant pivots with no learning, chasing hype cycles)

No long-term vision or path to profitability

Part 3: Role(s) to Target

People love to say “the role doesn’t matter if you’re on a rocketship.” That’s half-true. Stage, industry, and team quality matter most. But your seat does affect how much you learn, how much impact you can have, and how fast you grow.

The simplest way I think about it is product vs distribution: builders create the product; distributors get it to market. As a generalist, you often won’t know yet which side you’ll thrive on. The smart move is to pick a role that lets you test both—or, if you already have a hypothesis, choose a role that gives you proof points.

I recommend targeting 1 role—2 roles MAX. This helps you tailor your story, strategy and outreach to that role (or focus area, as roles often aren’t super defined for non-technical startup generalists).

Here are the most common “generalist” entry points:

Chief of Staff / BizOps – High leverage role, usually available from Seed/Series A onward. You’ll get visibility across the company, but success depends heavily on chemistry with the founder and whether they truly empower the role.

Sales / GTM – Strong fit if you’ve been the customer (e.g. ex-bankers going to Hebbia, ex-lawyers at Harvey). Early hires often need to sell founder-to-founder, so credibility in the industry matters more than sales training.

Growth / Marketing – Typically late Seed to Series A. Startups don’t invest here until they’re ready to scale. You’ll need some baseline experience, but being early lets you shape positioning and channels from scratch.

Customer Success – Often Series A+. Great for anyone with account management or client-facing background. You’ll become the voice of the customer internally while owning revenue retention.

Product Manager – A classic “generalist” role, but harder to break into cold. Expect stronger filters around technical literacy or prior product-adjacent projects. Internships, work experience you can frame as “PMing”, or side projects help.

Finance – Rare before Series B or lumped with BizOps. Often starts as a fractional CFO or outsourced accounting. Strategic/IR roles may exist at later stages and be a good fit for ex-professional services backgrounds.

Program Manager – Emerges later (Series B/C) when engineering needs coordination across teams. More structured, less blank-slate.

Strategy (& Ops) – Rare at true early stage. Sometimes shows up at Series B+ in ops-heavy models (e.g., marketplaces like Traba or EliseAI). You’ll tackle big bets or new vertical launches. In software/infra, these roles are less common.

Platform/Ops roles in VC – An unconventional but underrated entry point. Venture firms often hire generalists into “platform” or “portfolio ops” roles—helping dozens of startups at once with hiring, go-to-market, community, or operations. These roles give you inside access to a company, daily exposure to founders, and a direct path into operating roles. If you’re not sure which startup to join yet, this can be a powerful way to test across many.

Pitching Your Own Role – Don’t overlook this route. If you see a gap the company isn’t filling, propose it. The best approach: (1) understand what the company needs most, (2) position your unique skills against that, (3) validate with informal chats before making an ask.

Bottom line: Don’t just ask “what’s open?” Ask: Which role best positions me to learn, prove myself, and move me closer to my goals?

Part 4: Get your foot in the door

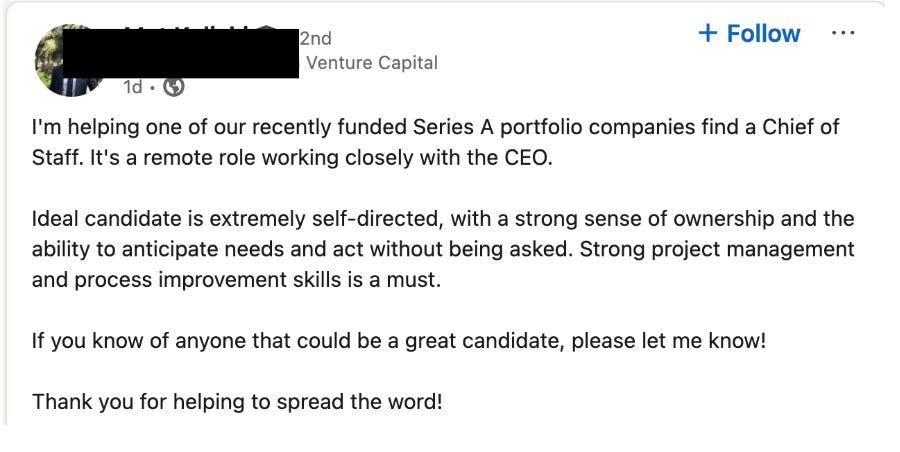

Many startup roles aren’t formally posted on LinkedIn. It costs money daily to keep a job posting up, so many startups opt to post them informally as posts or ask for referrals from their network, especially at the early stage. This means it’s hard to get a job just by applying (which tbh is increasingly true no matter the industry!).

Think from first principles: Based on your target companies and roles, where can you best reach people who are hiring?

1. Cold Outreach

This is the #1 way most people will get a startup role. It’s more scalable than attending events and conferences, and allows you to target exact individuals. Keep it simple, specific, and easy to say yes to. (I even built Connextion to get you started.)

Cold outreach 101

1️⃣ Prioritize warm-ish leads as much as possible → Target people with shared schools, industries, past companies, or any other affiliations you can find. Get in touch via a mutual connection. Meet them at a conference and follow up.

2️⃣ Be specific → Write like the message could only have been for them. Read their content or listen to a podcast they were on and reference it. Be clear about what you’re asking and offering.

3️⃣ Make it easy → Ask for 15 minutes, offer times to chat after they say yes (in their timezone), make the value you bring obvious. They’re missing out if they don’t connect with you.

Template:

Subject: [Your Background] > [Target Function] interested in [Company]

Hi [Name] – I really admire [Company]’s mission of [insert company mission/value prop] and would love to learn more.

I’m a [your background, if different from role] interested in [target role/function], looking to join an early team building [describe industry/product impact].

Currently, I [current role + scope], and before that I [relevant past role + quantifiable achievement]. I’ve also [optional: side project / personal brand / unique differentiator].

I like what [Company] is building and am ready to [two key verbs: strategize + execute / build + scale / sell + expand] in [target function]. Worth a 15min chat?

[P.S. If you’ve read any of their content or have a valuable idea/resource to share, add that.]

[Your Name]

⚡Don’t just reach out for specific jobs. Look for people at companies/roles you’d be interested in working at, regardless of whether there are job openings. Reach out to learn about their experience. You’ll build your knowledge base and your network.

2. LinkedIn as Your Landing Page

For both of my last startup offers, no one ever asked for my resume. They had my LinkedIn. What mattered was the experience and aptitude I showed in interviews and take-home assignments. So:

Make your LinkedIn profile easily digestible by a founder, hiring manager, or recruiter. It’s not rocket science - have a profile pic, a summary that sounds like a human wrote it, and include keywords in your headline that someone searching for your target role would use.

Engage with posts in your industry. This helps your profile get seen.

Consider posting IF it communicates your value (e.g., if you’re in product, show how you built something; if you’re in marketing. Posting is literally a way to market yourself, and it may help you rank higher when people hiring for talent search for your title). More and more startup founders in 2025 are building personal brands on LinkedIn, so no, it’s not cringe.

For certain industries, Twitter may serve a similar purpose (e.g. crypto, VC, etc.)

⚡Find “secret” jobs: On both LinkedIn and Twitter, search for informal job postings shared by teams hiring by typing "hiring" + “your target role”. These look like:

3. Recruiters / Startup Talent Leaders

Specialized startup recruiting firms are worth knowing. Examples: Golden Gate Recruits, Candidate Labs, Omna Search, plus more firms you’ll find on LinkedIn. Often they’ll reach out to you if your LinkedIn is targeted towards the roles/industries you’re interested in.

Kyle Thomas and Jordan Mazer are a few of many excellent VC/startup talent leaders who curate and post excellent lists of startups with job openings.

4. VCs job boards and networks

VCs often publish open roles from their portfolio companies. A few to start with:

+ VCs that target specific industries of interest

⚡Make VC friends: Start going to events (see below) and/or (re)connect with investor friends. They’re often the first to hear about opportunities in their portfolio companies and can be especially great sounding boards when you’re conducting due diligence on companies.

5. Startup/tech-specific job boards

6. Newsletters

Next Play: startup roles, early stage and growth.

Ali Rohde Jobs: BizOps/Chief of Staff roles in Big Tech and startups

Nonlinear Techies: BizOps, Chief of Staff, GTM, Finance and more

AI Operators: BizOps and Chief of Staff roles at AI companies

#SoYouWantToWorkInPlatform: VC platform/ops roles

probably many more!

7. Events & Communities

Events are not a good “get a job quick” strategy. Their value is more indirect - you might meet someone you vibe with at an event who connects you with someone else 2 months later who wants to hire you. They’re also a great place for quickly ramping up on the startup ecosystem, industry jargon, trends, etc. An ever-growing list:

Local happy hours / meetups → check Luma, LinkedIn, or Twitter for what’s happening.

Tech Week - NYC, SF, LA

Startup/venture groups for alumni of your university

Communities (online and irl): These might not always be startup-focused, but places like Ask a Chief of Staff, Chief of Staff Network, Pocus’ GTM community can be great resources depending on your target role

⚡Weak ties get you the job. Don’t forget to tell your friends and your friends of friends about the roles you’re looking for. This is also why building a personal brand attracts professional opportunities - you stay top of mind (I talk more about this on LinkedIn if you’re into that).

Part 5: Interviewing (and due diligence)

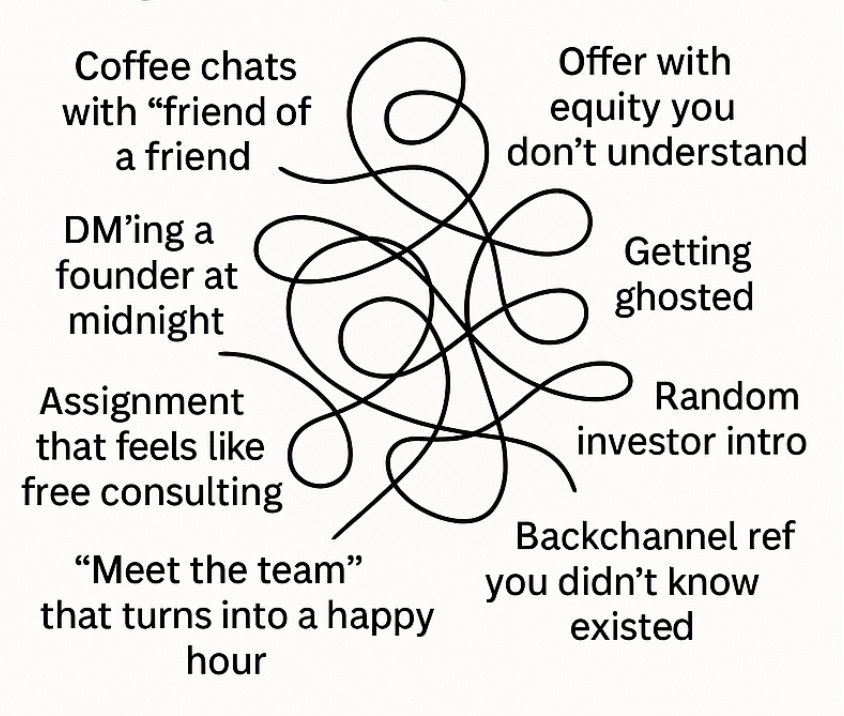

This is a short section because startup interviews don’t follow a playbook. There’s no structured “superday” or predictable case interviews like banking or consulting. The process is usually scrappy and fast. I’ve been asked everything from my childhood hobbies to how I’d explain public transit to an alien 👽

The interview process goes something like this:

Intro call or coffee chat (probably from your cold outreach) with the founder or hiring manager, depending on role/stage

Conversations with 1–2 team members to pressure test fit.

Case or assignment tied to the role.

Final step: onsite meet-the-team, or a multi-person panel online. Reference checks.

Occasionally, investors may interview you or weigh in, but usually only for more senior roles.

What matters most

Show that you can do the work already. They should leave saying, “Yep, this is our next team member.”

Tell me about yourself → clear, simple story. Keep it under 2 minutes. No jargon, no resume dump.

Past: Where you started and key skills you built.

Present: What you’re doing now and your “through line.”

Future: Why this startup/role is the next logical step.

Company/industry understanding. Show you’ve done your homework and learn to speak their language. Read founder blogs, customer stories, funding announcements, research reports…anything you can get your hands on. Steal this interview-prep prompt from Jordan Mazer, who’s interviewed 30,000+ candidates. Better yet - talk to their ICP. When I interviewed at a startup building AI for finance teams, I talked to a friend who worked as a startup Head of Finance and brought those insights to the interview.

Demonstrate fit. Every startup hires based on values, skills, and attitude. Before interviews, make a list of what matters to them (speed? customer obsession? analytical rigor? experimentation?) and match each with a STAR story from your past.

Case/assignment. These are usually a good benchmark for the type of work you’d be doing on the job. This isn’t about a “right answer.” They want to see how you think and how you’d hit the ground running. Start from first principles (think: based on the job description and what challenges the company is facing, what might they ask me to do?), show your work, and document your process.

Sample questions (e.g. for BizOps…but think beyond these):

“Our sales cycle has slowed down from 6 weeks to 12 weeks. As Chief of Staff, how would you diagnose and propose next steps?”

“We are planning to launch a [new product]. You can assume no work has been done yet to prepare for this product launch. Please prepare a product launch plan so that we can go live in 90 days.”

“Please estimate the LTV of an average customer.”

More tips

Ask clarifying questions upfront.

Show what you uniquely bring to the table: past experience, differentiated perspective, out of the box tactics (e.g. talking to a real customer).

Due diligence

You are also interviewing them! It can be tempting to take the first offer just to break in — but with startups, you need to be even more careful than with big companies that already have established reputations.

Ask yourself from first principles:

Does this company/role help me achieve my goals?

Is the market (TAM) big and growing?

Do I believe in the team, especially the founders and the people I’ll work most closely with?

Here are sample questions you can adapt depending on the company stage and role. (Compensation-specific questions in the next sections.)

1. Product & Market

What are your biggest signs of product-market fit - retention, growth, feedback, etc?

How do customers describe the value they get (in their own words)?

What are your biggest challenges today, and what’s on the 6–12 month roadmap?

Who are your main competitors, and how do you differentiate?

2. Go-to-Market & Customers

Who is your ICP today, and how do you see that evolving?

Walk me through your average sales cycle: deal size, length, and champion.

How do customers typically hear about you today?

3. Business & Financials

What metrics do you track most closely? How are they evolving?

What’s the current burn and runway?

What milestones are you aiming for before the next raise?

How do you make money, or plan to make money?

Who are your top investors, and how actively do they support you?

4. Team & Culture

How do you make decisions as a leadership team?

How do you handle disagreements among cofounders?

What does success look like for this role at 30/60/90 days?

What cultural traits do you actively hire for (and screen out)?

5. Vision & Strategy

What does the company look like in 5 years if everything goes right?

What’s the biggest risk to the business right now?

Which external factors do you see as tailwinds or headwinds?

6. Role-Specific Execution

How do you currently measure impact for this function?

Where do you see the biggest white space for this role in the next 6 months?

How do you want this function to collaborate with other teams?

What parts of this function have been founder-driven, and which are you looking to hand off?

Part 6: Compensation $$

People who tell you “comp doesn’t matter at startups” are the same people who tell you that unpaid internships build character. I’m not these people.

The reality: you need to weigh learning + growth against stability + pay, factor in your personal/financial situation.

Startup comp = cash + equity + bonus (commission for sales roles, rare for other roles).

Cash: Lower than big tech at Seed–B; more competitive by Series C+.

Equity: Can be valuable, but most options never pay out big. Some people say equity is like a lottery ticket but I don’t think that’s quite right - you should have conviction in your company! Weight it probabilistically, not as guaranteed.

Benefits: Negligible at most, particularly early stage. You’ll likely have health insurance but rarely 401K, HSA, etc.

A few benchmarks:

Golden Gate Recruits’ compensation survey for startup generalists

Vinay Iyengar wrote an excellent guide on startup recruiting in 2024, with an especially helpful section on specific cash/equity ranges at different startup stages, levels of experience and types of roles. That said, these numbers are low as of 2025, esp. in hubs like NYC/SF - I’d tack on ~$20-40K.

Always get fresh numbers: Even if you’re reading this 6 months from now, the numbers may change. Use recruiters, VCs, and other operators in similar roles as your best data points (build those relationships!). These change quickly over time, by industry (e.g. B2B vs B2C), location, stage, other benefits, economic trends…

For example, as of writing this article, a Chief of Staff / BizOps role based in NYC/SF at Seed - Series C, for 3-5 years of experience, pays $150 - $190K base, 10-30 basis points of equity, with more firms offering bonuses on top.

Understanding Equity

Equity is where most people misunderstand their startup offer. Before you even start calculating ownership, you need to know what type of equity you’re being granted:

Stock Options (most common at early stage):

You get the right to buy shares in the future at a fixed price (the strike price). You usually need to pay cash to exercise, and the shares only have value if the company’s price later exceeds your strike price.RSUs (Restricted Stock Units, more common at late-stage / public companies):

You don’t buy anything — shares are granted to you outright once you meet vesting conditions. RSUs don’t require upfront cash.

Once you know the type, here’s how to evaluate what your equity is really worth:

Calculate the dollar value today and your ownership.

Example: If you have 10,000 options, the strike price is $0.10, and the current price implied by the latest round of funding is $3.00, your equity value is 10,000 x ($3.00 - $0.10) = $29,000. Compare this to the company’s post-money valuation (i.e. valuation after the last funding round) to see your ownership %.Run exit scenarios.

Model your payout at different exits ($300M, $500M, $1B, $5B…). Then reality-check how likely each is. Try this equity calculator from Carta. Startups may give employees their own equity calculators. These are great, but be sure to test assumptions and be skeptical if a company claims it can reach a $100Bn valuation!Understand dilution.

Every new fundraising round expands the total shares and shrinks your % ownership (est. 15-20% per raise). Even if the company grows, your slice of the pie may get smaller.Check vesting terms and refreshers.

Most grants vest over 4 years with a 1-year cliff, meaning if you eave before 12 months, you get nothing, and a quarter of your total equity grant vests every year. Most startups will also grant “refreshers” or additional equity beyond the initial grant - figure out what the policy or expectation is.Consider the opportunity cost of equity compensation.

If you have financial constraints or near-term goals to account for, calculate how your projected equity value in X years compares to investing the equivalent cash comp (presumably at a larger company) in other assets.

With that quick context, here’s a starting point of questions to ask so you can evaluate both the current value of your equity and its future potential:

Ownership & Denominator

How much of the company do I own? How is that % calculated?

How many total shares exist? What convertible notes/SAFEs/warrants exist, and how much dilution will they create?

How much money has been raised in total?

Valuation & Share Price

What was the post-money valuation and share price in the last round?

What is the most recent 409A valuation and when was it last updated? (this is the option strike price)

At what exit valuation would common stock actually have value? (occasionally, there are thresholds to reach for preferred stock before common stock has value)

What are the most likely exit paths (IPO, acquisition, staying private)?

Grant Terms

What’s the vesting schedule? Any exceptions or acceleration on change of control?

Can I exercise early?

What happens to unvested/vested equity on termination?

Is there a policy of reloading or refreshing grants?

Part 7: Last/random thoughts

Think for yourself. Don’t chase a “hot” startup just because a Twitter thread or LinkedIn thought leader said to. That’s why I’m not sharing (another) list of startups I think you should join. Do your own research, form your own convictions, and don’t be afraid to be contrarian (e.g. work at OpenAI when everyone thought AI was useless).

80% is enough. Start with a defined target list, but take off your blinders. If a company checks ~80% of your boxes, it’s worth exploring. It’s like dating…the best fit may not match every criteria on paper.

Stay organized. Too many chats, apps, and follow-ups can slip. I recommend using a simple Notion or spreadsheet to log outreach, conversations, and applications.

Prioritize genuine connections. This guide has focused on tactics, but the best opportunities often come from curiosity-driven interactions where you’re not pushing an agenda - just trying to learn and help others. Once you break into startups, your reputation and network will matter way more in landing you your next role than any tactics or resources in this guide.

Further reading

Always be learning!

Startup careers

Paul Graham Essays — YC co-founder’s classic essays on startups, culture, and building from first principles.

Sam Altman: How to Be Successful — YC co-founder’s perspective on career, startups, and compounding advantage.

The Operator’s Dilemma (Notion VC) — a guide to navigating your career across early-stage, build, and scale phases.

Tech newsletters & podcasts, operators/builders to follow

Stratechery (Ben Thompson) — sharp analysis on strategy, tech, and business models.

Benedict Evans — what matters in tech

Lenny’s Newsletter — tactical breakdowns on product and growth

a16z Podcast + Newsletter — perspectives from Andreessen Horowitz partners and portfolio founders.

Andrew Chen — essays and insights on growth, networks, and scaling startups.

First Round Review — deep dives from early-stage operators and founders on product, growth, and culture.

Dan Hock — generalist startup operator with thoughtful takes on product, growth, and operating at scale

Molly Graham — “give away your legos” essay, early leader at Facebook

If this was helpful, please subscribe. I share occasional long-form writing and curated startup jobs for generalists.

Wow this is amazingly comprehensive and detailed. Appreciate the work you put in to share this with us!

Super useful breakdown, learned a couple of new angles here.